Accounting is not just bean-counting; it creates money

Posted by Toby York. Last updated: February 9, 2023

This is a brief introduction to the nature of money and its relationship with accounting. It explains how accounting creates money. This is a fun way to introduce accounting, making learners think differently about accounting.

Accounting isn’t just about counting beans — it makes them too. It may be hard to believe, but real money is created with a nifty bit of double-entry bookkeeping. To understand how this works, we need a close look at those beans — money.

Banknotes and coins are money, but physicality is not the defining feature of money. This is clear from the “invisible money” we use daily hiding in our plastic cards, mobile phones and computers.

Invisible money is not a recent phenomenon. The history of civilisation is scattered with examples of economies flourishing without physical money. For example, the Pacific island of Yap, isolated from the rest of the world until the late nineteenth century, used giant immovable “fei” stones to support a credit economy. John Maynard Keynes described its ideas about currency as“more truly philosophical than those of any other country” [1].

Become a member

We’re building a community for students and teachers to learn from each other. Currently, membership is free.

Join todayIt’s difficult to say how much invisible money exists, not just because it changes all the time, but because definitions are hard to pin down — just ask an economist. Or an accountant. Or yourself. Would you include cryptocurrencies [2], long-term deposits, and short-term government bonds? Whatever the definition, banknotes and coins are likely to make up less than 10% of the world’s money supply.

The defining feature of all invisible money is that it exists only as a balance — a record in an accounting system. Whether on a screen or paper is not what matters — money is, in essence, no more than a mark of a promise.

An example will make this clearer.

Show me the money!

Yana wants to buy a car but doesn’t have enough cash. She thinks a bank might have some, so she asks Big Bank for £1,000.

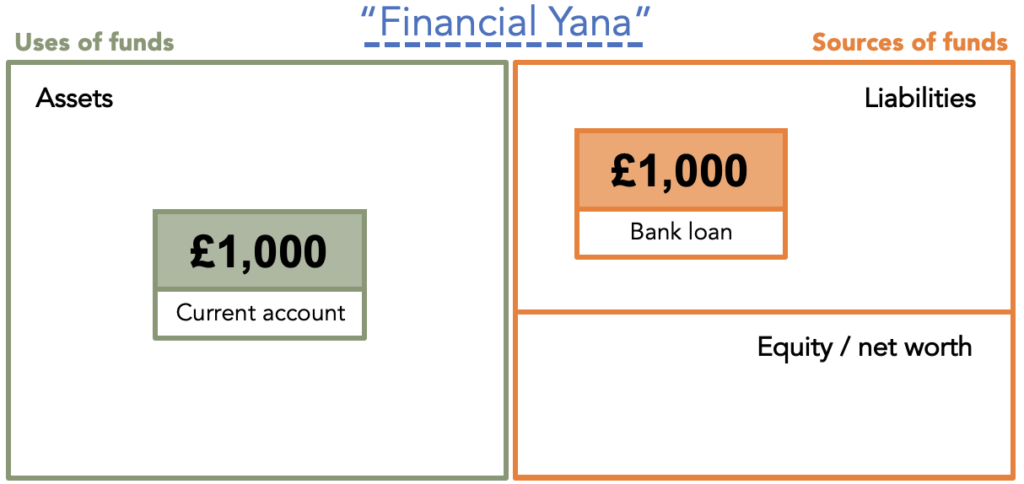

The bank agrees, and Yana signs a loan agreement, after which £1,000 magically appears in her current account. She now has £1,000 more cash and an obligation of £1,000 to the bank. In her accounting records, assets and liabilities both increase by the same amount.

The bank’s accounting records are even more interesting because this is where the magic happens — well, the conjuring trick — because the bank doesn’t go to its cash cupboard to stuff Yana’s pockets with money. It makes an accounting entry. And that’s it—the money appears from nowhere.

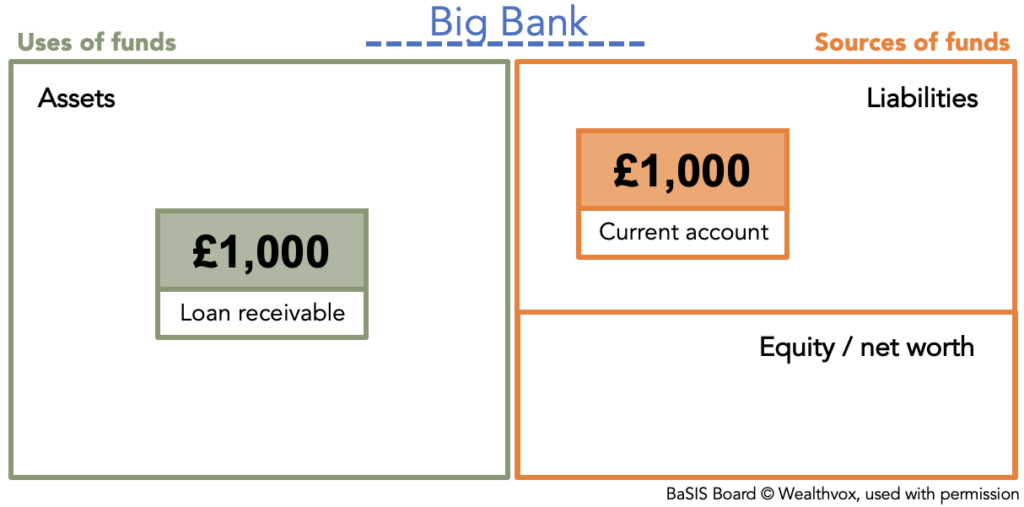

Here’s the loan to Yana from the bank’s point of view. Yana’s loan obligation is recoverable by the bank, so it’s valuable. It’s an asset. Big Bank’s asset is Yana’s liability.

The increase of £1,000 in Yana’s current account is in liabilities — the £1,000 that Big Bank has agreed to make available to Yana. Yana’s asset is Big Bank’s liability.

The bank has created cash (and the loan) using double-entry bookkeeping. It really is that simple: Yana owes us, so we owe Yana — boom! — £1,000 is now in the economy that wasn’t there before.

Don’t try this at home

Don’t be fooled into thinking that anybody can do this [2]. It only works because we all believe that the balance on Yana’s current account is cash. Because we believe in money, Yana can easily transfer that balance to someone else or go to an ATM to withdraw the balance as physical money.

Being able, at will, to convert invisible money into physical money maintains our belief in the magic, but this, to some extent, is also illusory. The banking system will collapse if everybody simultaneously goes to the banks to convert their current account balances into cash — there’s not enough physical cash in the world for that.

Governments understand that our trust in money and the banking system are essential threads that hold the fabric of society together. That is why they do almost anything to keep the banking system functioning — as they did in the 2007/8 financial crisis.

Resources

The Bank of England has published a series of articles and videos that deal with this topic in a broader context:

Notes and further reading

[1] I recommend Felix Martin’s Money: the unauthorised biography (Bodley Head, London 2013). Martin’s book is a wonderfully readable treatise on money as an accounting mechanism.

[2] The existing standards are applied in the absence of an accounting standard for cryptocurrencies. Cryptocurrencies fail the definition of cash equivalents under IAS 7 Statement of Cash Flows. Neither are they financial instruments under IFRS 9 Financial Instruments. This leaves them, for the time being, under IAS 38 Intangible Assets. [For a more detailed explanation, see this ACCA Technical Article: Accounting for cryptocurrencies.

[3] Although many people did exactly this during the Irish banking crisis of 1970 when the banks closed, and people were forced to exchange personal IOUs without cash and bank clearing. Again, see money: the unauthorised biography by Felix Martin for the whole story.

[4] This isn’t any more real than a bank balance. In the UK, all banknotes issued by the Bank of England declare, “I promise to pay the bearer on demand the sum of £X”. This dates from when the person holding the note could exchange it for gold of the same value. Sadly, you can no longer do this. You can only exchange your banknote for other banknotes of the same face value. That is, you can swap one paper promise for another paper promise.