DEAD CLIC: it’s time to kill it off

Let’s be clear. Nobody learns the fundamentals of accounting by using DEAD CLIC. Mnemonics may have their place, but this isn’t one to keep. Let’s kill it off.

A friend told me that when she was learning accounting, she dared to ask, “Why do debits increase both expenses and assets?” This didn’t seem to make sense to her because a debiting effect on expenses reduces value in the entity, and a debiting effect within assets increases value. How could two debiting entries on the same side of the ledger have opposite effects on entity value?

This is a reasonable question. In fact, it’s an insight that deserves a considered response. It presents an opportunity to develop the student’s understanding of fundamental accounting concepts that sit beneath debit and credit.

Instead, her teacher tried to explain and tried again, and then he shouted, “Because it just does!”

This was a long time ago, and I’m sure teaching has advanced since then, although you still see variants of “Because it just does!”. One of those is the mnemonic “DEAD CLIC”.

To be fair, mnemonic strategies are highly effective in the area of memory. For example, recalling lists of unstructured knowledge, like colours of the rainbow, or the list of cranial nerves. But, research shows their impact is strong on only one aspect of education — the recall of academic content. “Other areas of academic learning are not likely to be impacted primarily by mnemonic instruction” (Scruggs & Mastropieri, 2000).

If you haven’t come across it, this is how DEAD CLIC attempts to explain debits and credits:

D E A D

D — Debit:

- E — Expenses

- A — Assets

- D — Dividends (or drawings)

C L I C

C — Credit:

- L — Liabilities

- I — Income

- C — Capital

There are variations. DEAD RELIC (Revenue, Equity, Liabilities are Increased by Credits) is quite popular, but has the same shortcomings.

Become a member

We’re building a community for students and teachers to learn from each other. Currently, membership is free.

Join todayFive reasons DEAD CLIC doesn’t work for accounting

Many people teaching accounting today were taught using DEAD CLIC. That does not justify its use. Yes, it may be simple, but it’s not effective. Here are five reasons to kill it off.

- There’s no such thing as a debit or a credit! There are debit and credit sides to the accounting framework — in this sense, debit and credit refer to place or location. And there are debit and credit amounts. Combining the concepts of place and amount determines impact — whether the amounts are recorded as increases or decreases. See Myths, monster and curses for a deeper explanation.

- DEAD CLIC is a shortcut that helps students get to the right answer even when they don’t understand fundamental accounting concepts. It fails to provide the opportunity for deep learning. It skips over the conceptual roots of why assets and expenses are on the “debit side” and liabilities, income and equity are on the “credit side”.

- It fails to explain the relationship between the financial statement elements and accounting mechanics. For example, revenue/income is a transaction that increases assets or decreases liabilities. If a student understands structure and mechanics, then the language will follow.

- It’s wrong. Dividends (or drawings) are included within debits, but the dividend account sits within equity on the credit side of the accounting framework. “Capital” is incorrectly used as a synonym for equity. Capital is an ambiguous term, and accountants use it in many different contexts, for example, working capital, capital expenditure, share capital, and return on capital.

- There seems to be little point in being able to recall the contents of DEAD CLIC if you have no understanding of the underlying concepts. If you have a good grasp of the underlying concepts, DEAD CLIC is unlikely to serve any purpose.

Maybe mnemonics have their place, but this isn’t one of them. It’s time to kill it off.

What’s better than DEAD CLIC?

No one ever masters double-entry bookkeeping by using DEAD CLIC. At some point, consciously or unconsciously, accounting principles must be understood and learned. Trying to shortcut these makes learning slower and more challenging.

Our free Fundamentals of Accounting course, designed for teachers of accounting, uses stories, pictures and a concept map to explain accounting concepts in a way that students find accessible and memorable.

© AccountingCafe.org

What to read next . . .

Myths, monsters and curses

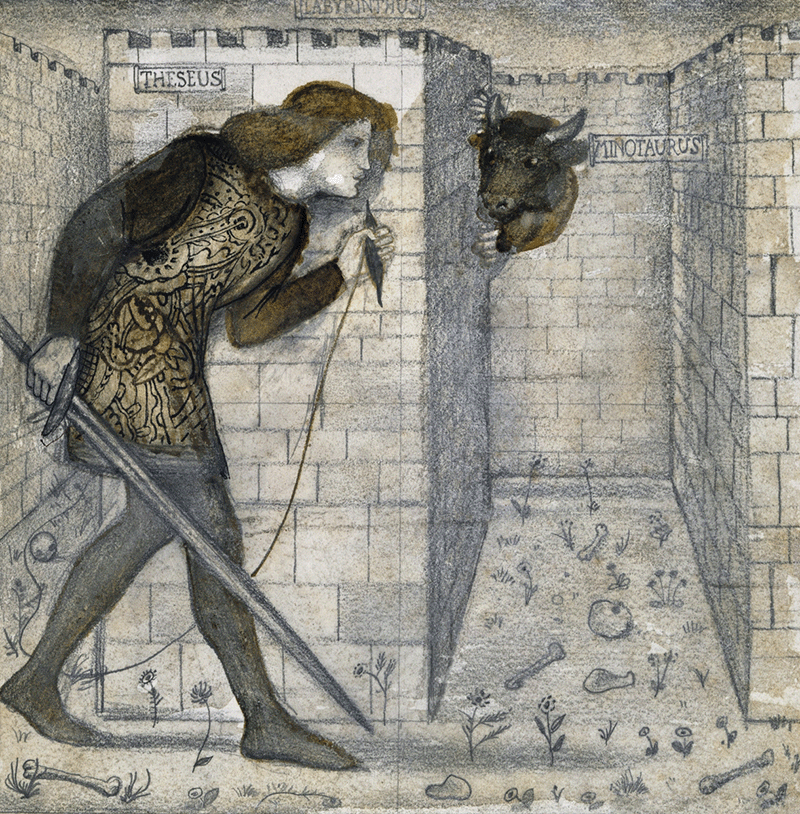

It’s a rite of passage, isn’t it? To slay the monster of debits and credits. Learn the rules. Use the tools. Debits on the left, credits on the right, DEAD CLIC and T-accounts.

These are our weapons of choice. We reassure students that if they use these often enough, they too will slay the monster, cross the threshold and become experts.

But are we sending our students into a labyrinth with tools to kill a monster that doesn’t exist?

References

Scruggs, T.E. & Mastropieri, M.A. The effectiveness of mnemonic instruction for students with learning and behavior problems: an update and research synthesis. Journal of Behavioral Education 10, 163–173 (2000). https://doi.org/10.1023/A:1016640214368

Entirely agree with killing off D-E-A-D-C-L-I-C!

I have often set a short test question which asks “if assets are so called good things and expenses are so called bad things, why do they both increase with a debit?” I would now ask it as “if assets are things of value and expenses are value sacrificing activities, why do they both increase with a debit?”

I disagree a little – although I would prefer that students get adequate the time to understand what they are doing at a deeper level isn’t there an argument to say that a tool such as DEADCLIC allows students to practise questions and build a ‘muscle memory’ for double entry? Conceptually double entry can be a real challenge, especially when students are grappling with difficult terminology at the same time. There’s some validity (from an experiential learning perspective) to giving students a crutch to allow them the benefit of practise to develop an understanding. I agree DEAD CLIC shouldn’t be the foundation of our teaching, but it has its uses as a learning aid.

OH my god, yes! DEAD CLIC is so unhelpful to me. It’s a mneumonic for showing what I need to do but not why I’m doing it, which is what I need and want to know to learn the material! There’s got to be a better way!

And I’m disappointed you didn’t show it 🙁

Although our Fundamentals of Accounting course is designed for teachers, you can use it to teach yourself.

Starting off it is a great tool. Deeper understanding will always come later for those who are fascinated by accounting (as I was). However DEAD CLIC helped massively in building my initial brain memory of debits and credits. At a foundation level, it helps students massively and increases their motivation if they do well.