Accounting during periods of general inflation

Posted by Toby York. Last updated: December 11, 2022

Historical cost accounting has its advantages but presents serious problems in periods of inflation.

Photograph used under the fair dealing provisions within the guidelines of the Intellectual Property Offices’ Exceptions to Copyright for Education and Teaching.

In Autumn 2022, the board in charge of the £100bn project to build HS2, the UK’s high speed railway, was criticised for using 2019 prices to report its current spending. This had the effect of reducing reported overspends. [1]

Is this simply a cheeky piece of accounting sophistry? In fairness, its budget was set when prices were significantly lower. The board presumably felt it was inconsistent (and a little inconvenient) to compare current costs with a historical cost budget. General inflation in the UK was running at a 40-year high of more than 10% and HS2’s costs were estimated to be increasing even more steeply. [2]

Accounting is founded on historical costs, so changing prices present serious practical difficulties, not just for budgeting, but for all aspects of accounting. These difficulties provoke important questions about the limitations of accounting that are worth exploring in the classroom.

Historical solutions

Previous solutions have focussed on re-stating historical costs to current prices, rather than the novel attempt by HS2 to restate current prices at historical costs.

The last serious attempt to address the problems followed a period of significant and prolonged inflation in the 1970s. UK regulators produced SSAP 16 Current Cost Accounting (1980), and US, FAS 33 Financial Reporting and Changing Prices (1979). Both standards were much unloved, very controversial, difficult to implement and regularly ignored—until they disappeared in the late 1980s.

Oddly however, remnants of current cost accounting survive within the current IFRS Conceptual Framework [3]. The mishmash of historical costs and fair values that we see in financial statements today shows that the problems of changing prices have really never gone away.

This article sidesteps the question of what measurement basis to use (cost or fair value) and looks at how we can account for changing prices.

The problem with using monetary measurements

The unit of measurement for financial accounts is monetary units—what we call the reporting currency. This might seem to be an unremarkable fact, but the value of currency refuses to sit still over time. Other measures, like metres or grams (or if you prefer, yards and ounces) are better behaved, but unsuitable for accounting.

During periods of low inflation, changes in the relative value of currency have an insignificant impact on reported values and profits. It is therefore practical and acceptable to use nominal currency values in financial statements.

This is not the case in periods of high inflation. To illustrate, I’ve lifted Geoffrey Whittington’s seminal example of “Fred the pineapple seller”. Whittington used this when SSAP 16 was first introduced and more recently in his authoritative book, Value and Profit [4].

Fred’s Fruit Emporium

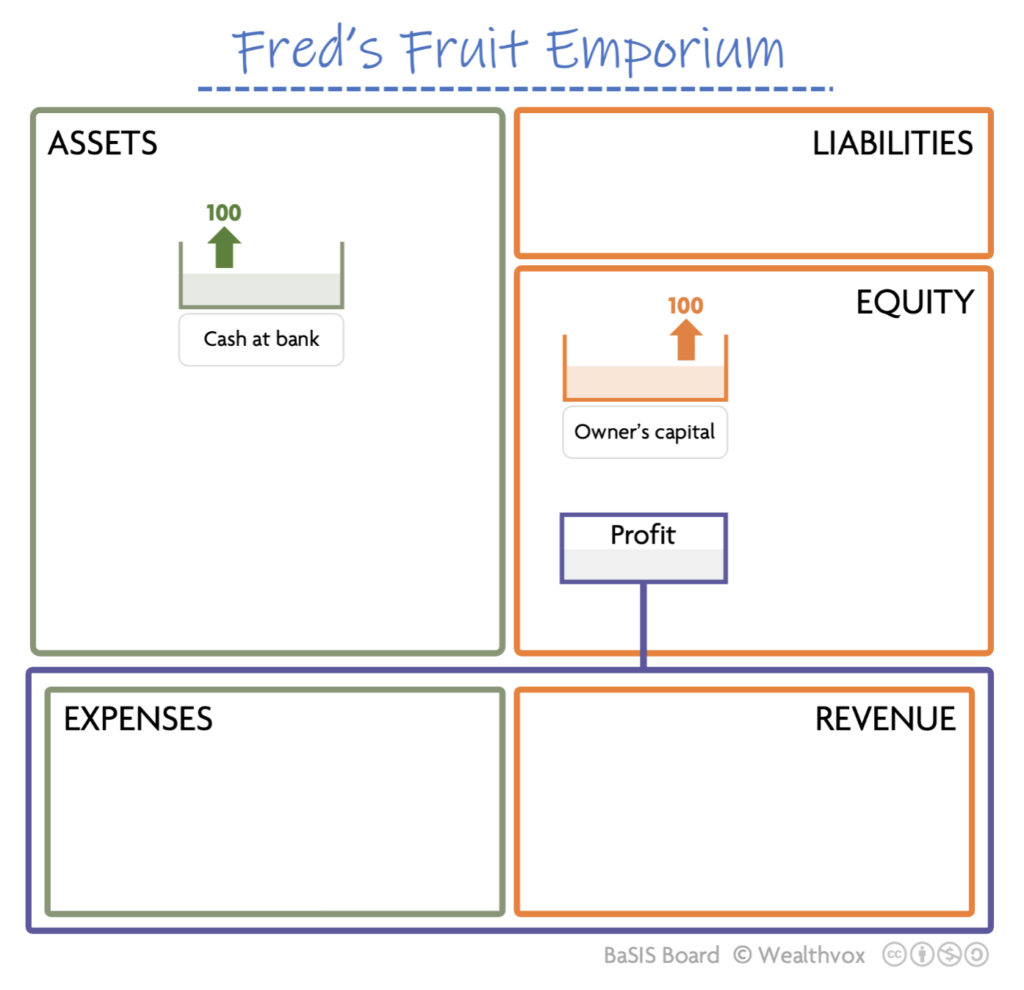

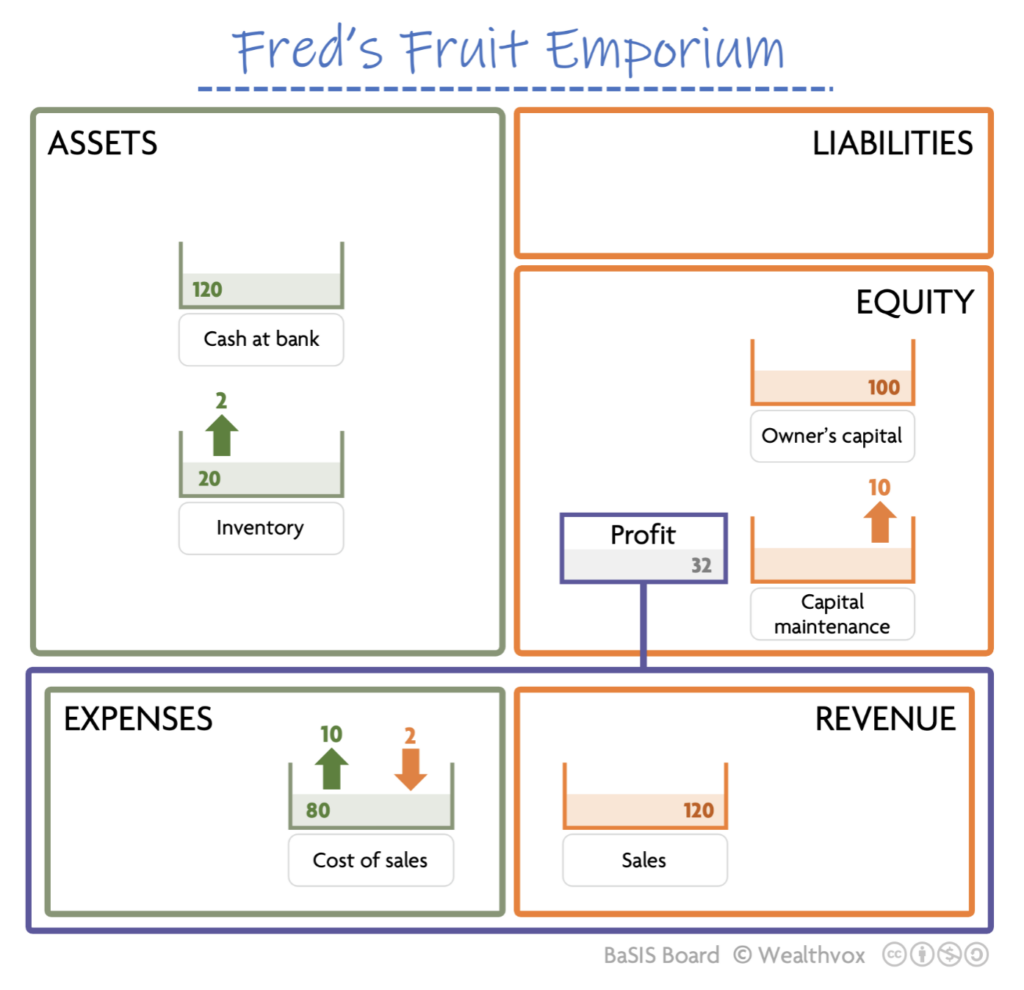

Fred is a sole trader. He starts in business with £100 of cash which he invests in a new business — Fred’s Fruit Emporium. We are showing this in the business accounts as cash at bank and owner’s capital.

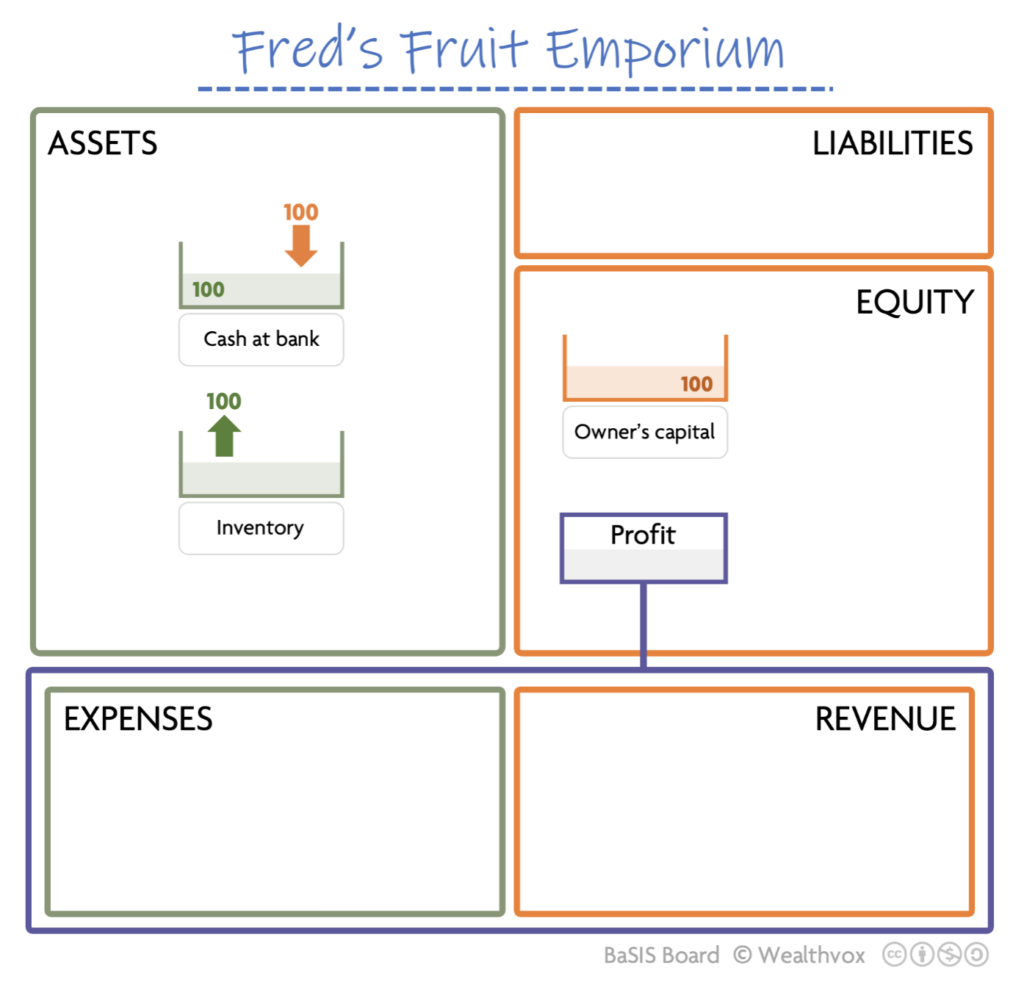

In his new role as Chief Fruit Buyer, Fred uses business cash to buy 100 pineapples for £1 each. At this point, the business has owner’s capital (equity) of £100 and inventory (assets) of £100.

Profit using historical cost accounting

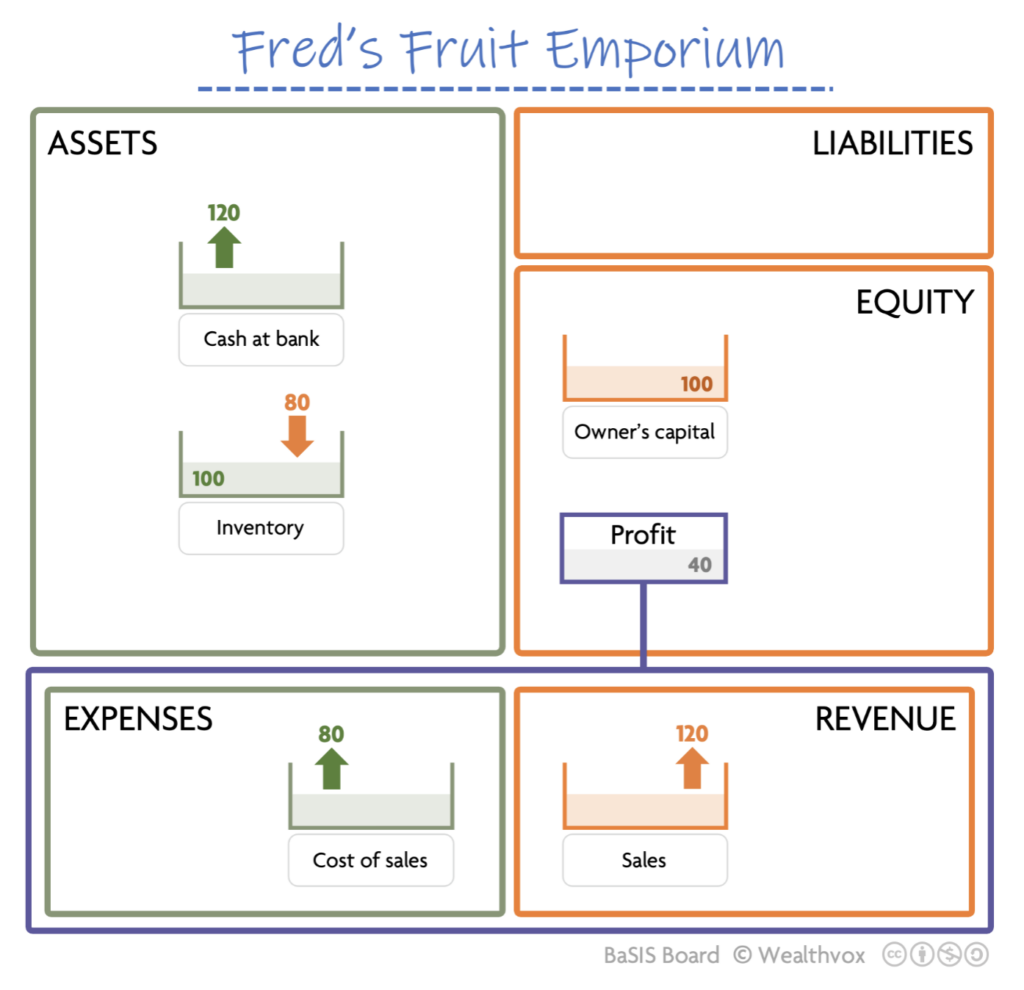

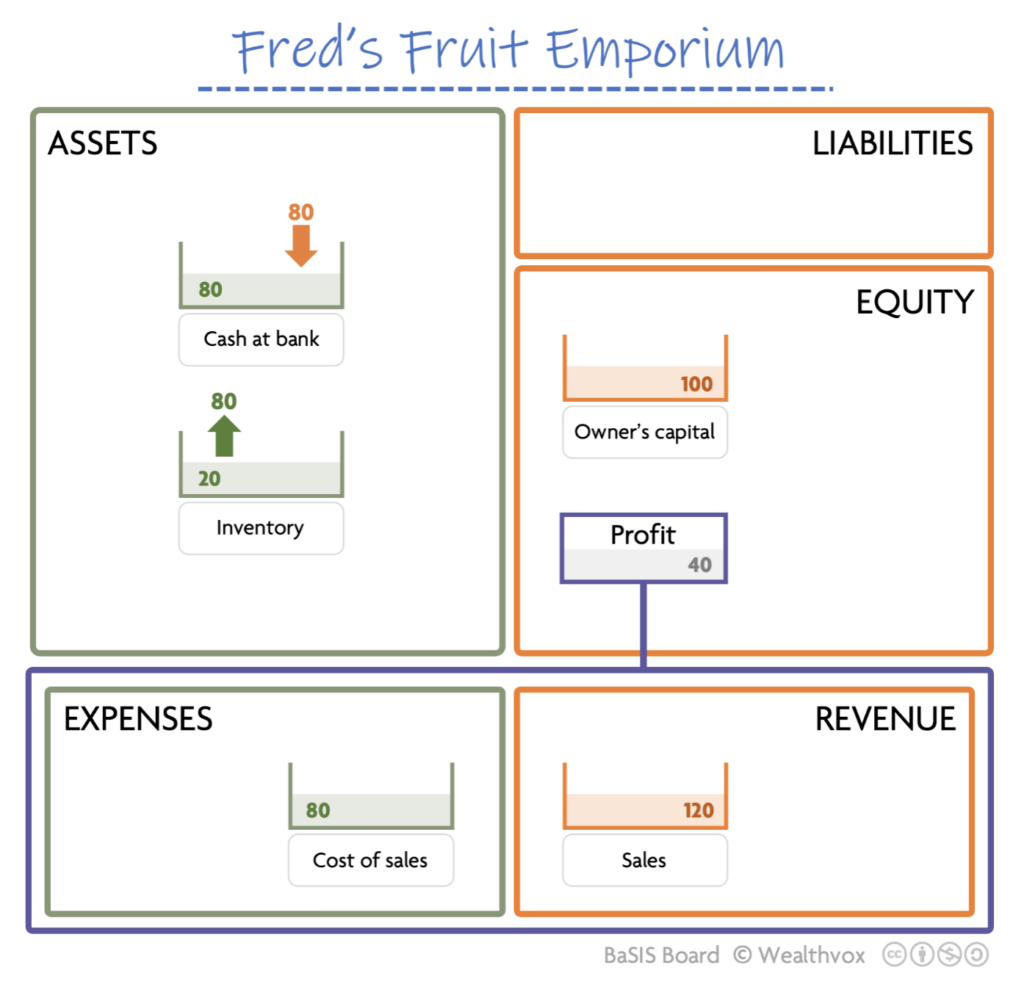

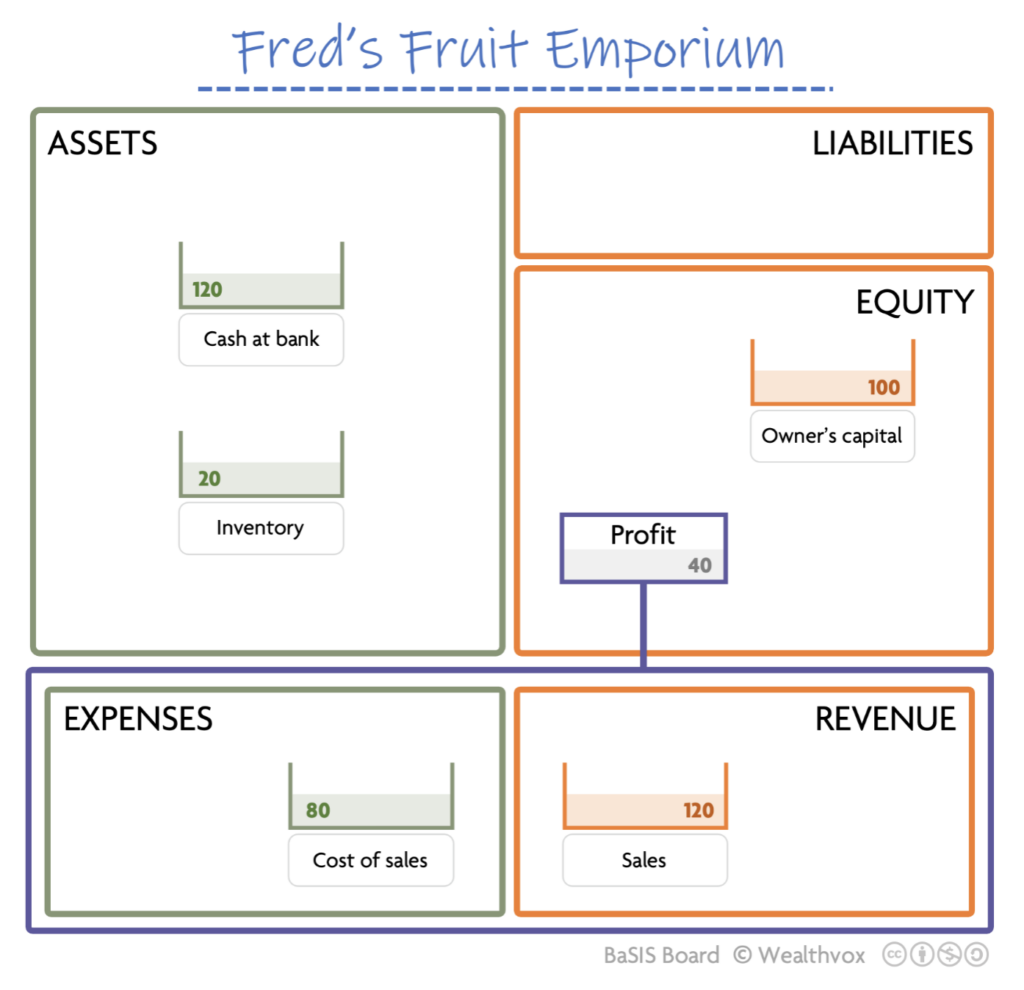

On its first day of trading the business sells 80 pineapples for £1.50 each, receiving cash from the sales on the same day. Total assets are now £140: including cash of £120 (80 x £1.50) and inventory of £20 (the 20 remaining pineapples, measured at their historical cost of £1 each).

We measure profit from a base of £100, the nominal amount of opening equity. Closing equity is £140, so Fred’s Fruit Emporium generated a profit of £40.

We are so used to describing profit in terms of an increase in equity (or net assets) that we barely give it a second thought. But in periods of high inflation, this way of measuring profits can be misleading. To understand why, we need to imagine what Fred does next.

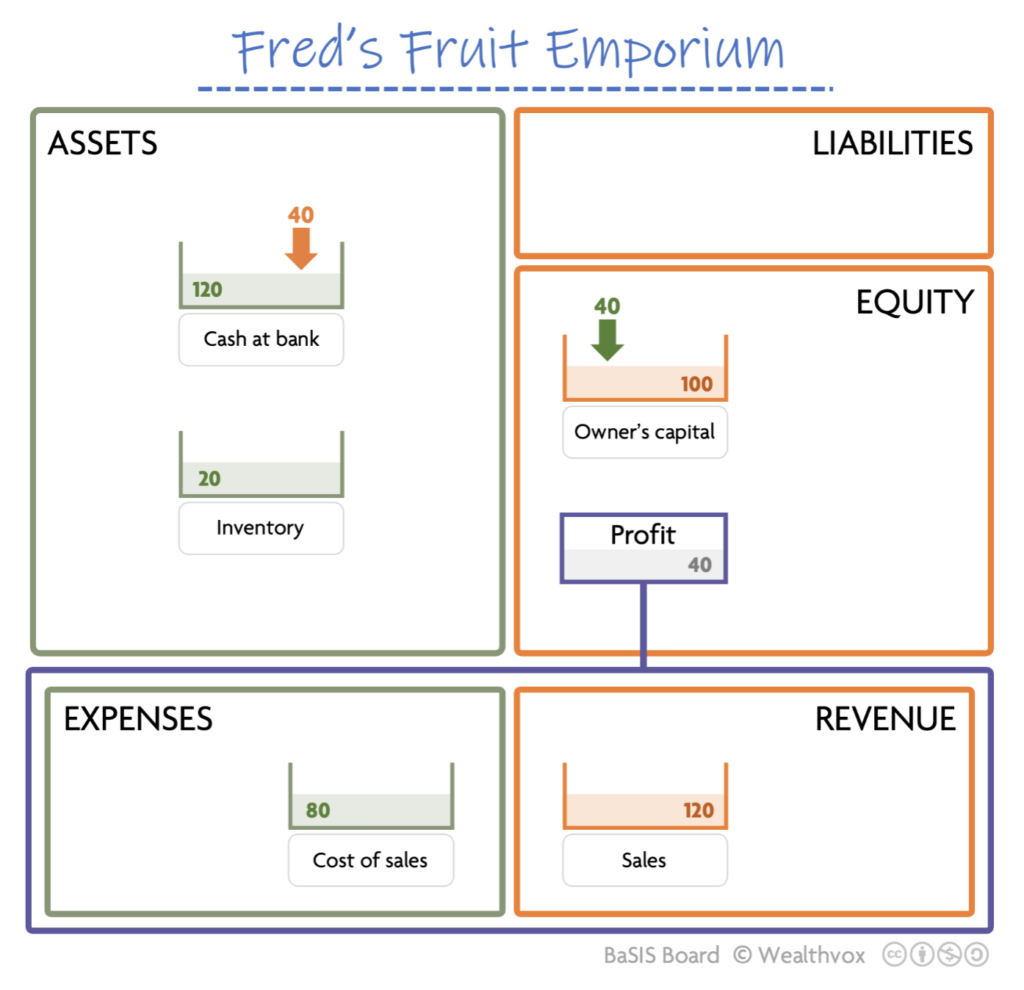

Fred has cash of £120 in the business. Let’s suppose that he transfers to his personal account cash equivalent to the £40 of profit. He keeps £80 in the business to replace the pineapples that were sold. This would bring inventory back up to the previous level of 100 pineapples.

When he goes to market the next morning he finds that the wholesale price of pineapples has increased to £1.25. This means that £80 buys just 64 pineapples (64 x £1.25 = £80).

Inventory is back up to £100 but the business has just 84 pineapples on hand — 20 at the original price of £1.00 and 64 that were bought for £1.25 each.

The operating capacity of Fred’s business is impaired because he withdrew all of the profits that were measured without allowing for rising prices.

Capital maintenance accounting seeks to remedy this. Let’s not get entangled with the term “capital”, as we’ve done that before (see Working capital is widely misunderstood). In this context, capital maintenance is concerned with determining an appropriate base value of equity from which to measure profit.

Capital maintenance accounting

Essentially, an entity maintains its capital if its equity at the end of the period is equal to equity at the beginning of the period. Any amount over and above that is profit.

There are two approaches to capital maintenance: the entity view which has the objective of maintaining the entity’s ability to replace its productive assets, and the proprietor view which aims to maintain the entity’s invested capital (equity) in real terms.

The entity view of capital maintenance

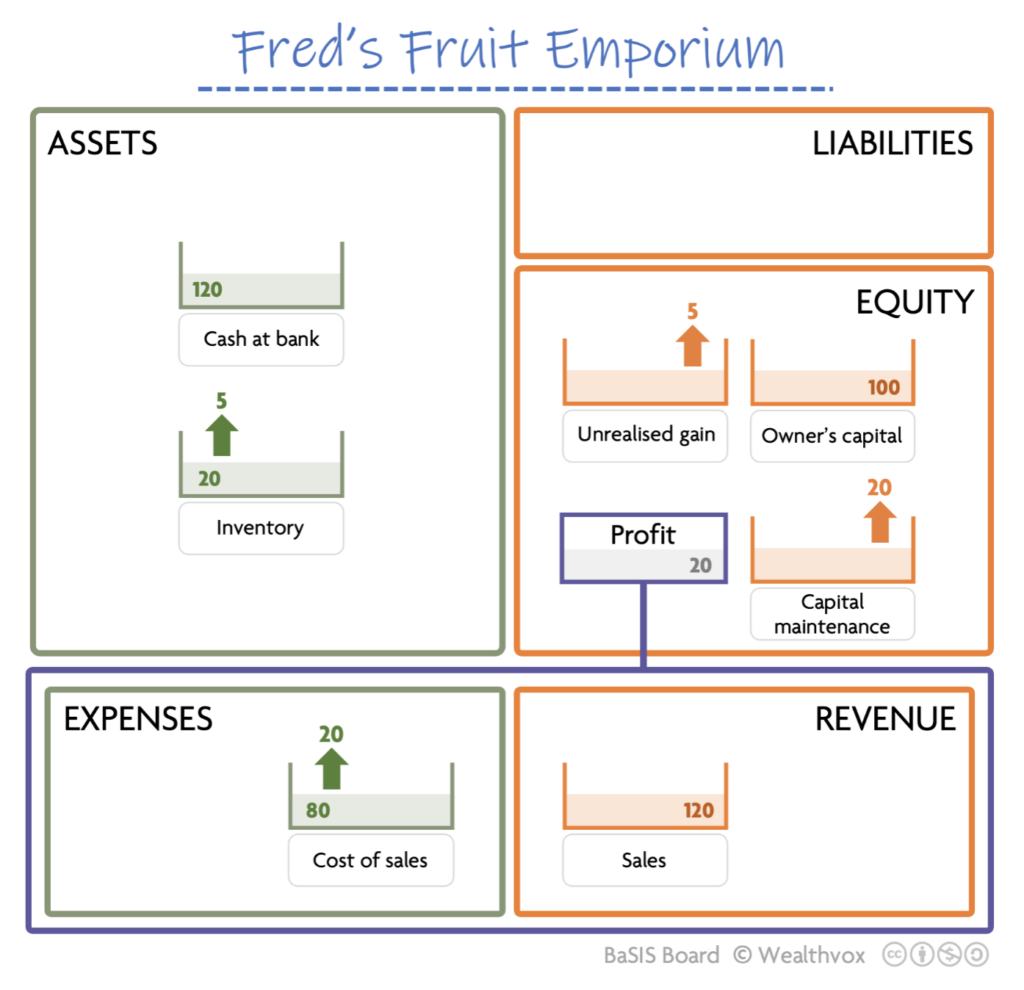

The entity view of capital maintenance seeks to measure profit while maintaining the operating capacity of the business. We’ll revert back to when Fred’s Fruit Emporium sold 80 pineapples for £120.

Here’s the income statement and financial position on a historical cost accounting basis.

This time around, we make the following changes to the accounting records.

- Cost of sales are recorded at the replacement cost of pineapples (£1.25), rather than their historical cost of £1.00. The additional expense of £20 (80 x £0.25) reduces profit. This is shown as an increase to the capital maintenance reserve within equity. [5]

- Closing inventory is also revalued using the replacement cost of £1.25. Inventory increases by £5 (20 x £0.25) giving rise to an unrealised gain.

Operating profit is £20 and there is a revaluation gain of £5, so total comprehensive income is £25. This is the increase in equity from an adjusted base of £120. Strictly speaking, these are not inflation adjustments because the changes relate to the change in the price of pineapples, not general prices.

Become a member

We’re building a community for students and teachers to learn from each other. Currently, membership is free.

Join todayThe proprietor view of capital maintenance

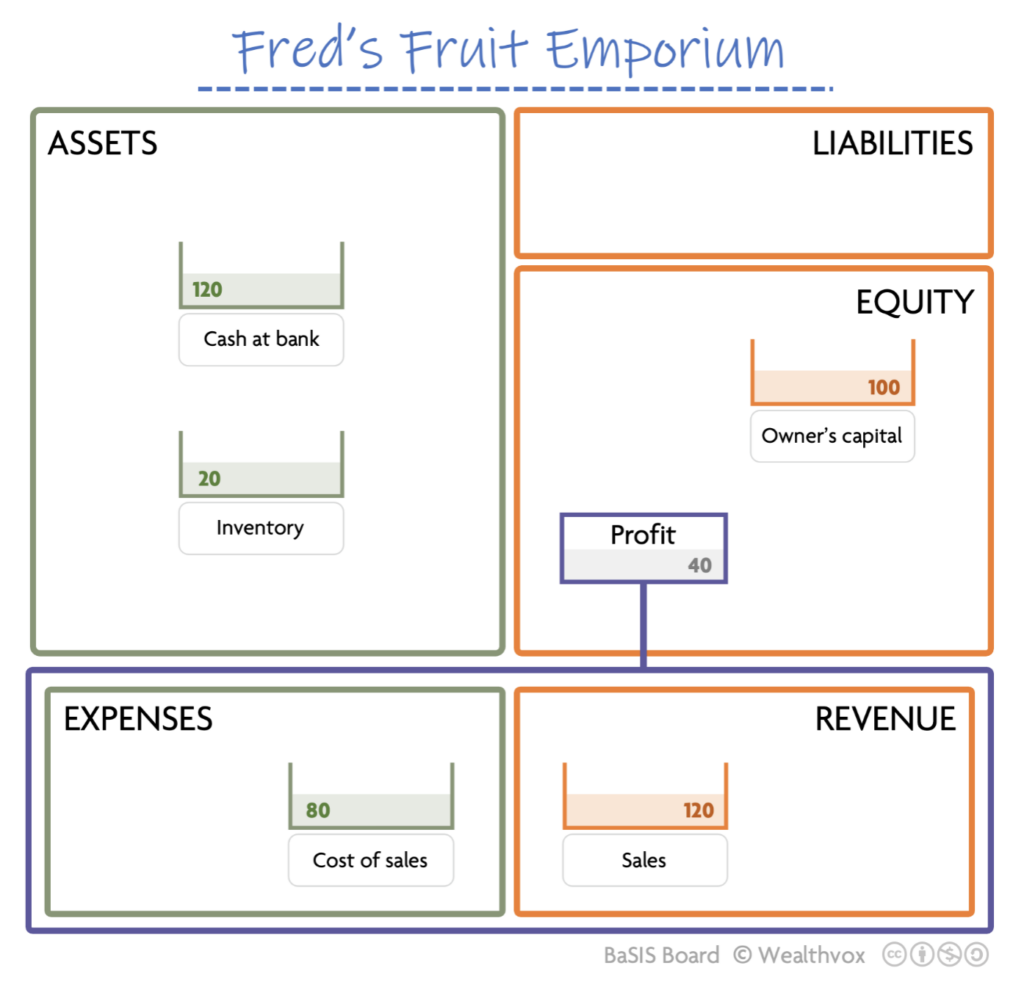

The proprietor view takes a different approach and seeks to maintain the value of equity such that it keeps pace with the purchasing power of money. For illustrative purposes, let’s revert again to the historical cost position.

Whittington’s example assumes (hyper-)inflation at a daily rate of 10% which leads to these changes to Fred’s accounting records:

- We adjust opening equity for general inflation, increasing it by £10 (10% x £100). This is shown as “capital maintenance” within equity. We also increase cost of sales (expenses) by £10 to reduce profit and thereby prevent Fred from drawing cash that has not been generated in real terms.

- Similarly, we adjust the value of closing inventory for inflation increasing it by £2 (10% x £20). Because this is not a revaluation of inventory, but a re-statement of historical costs, it results in a decrease in expenses rather than an unrealised gain.

We have increased expenses by a net £8. An increase of £10 for the inflation adjustment to equity and a reduction of £2 for the change in the purchasing power of inventory on hand. Fred’s Fruit Emporium reports profit of £32, which is the increase in equity from an inflation adjusted base of £110.

Other considerations

The board of HS2 may have better luck persuading its paymasters that all is well if it inflated historical cost budgets to current price levels rather than deflating current spending. But then again, maybe not.

And this is by no means a comprehensive outline of accounting during periods of inflation. The withdrawn accounting standards also required other changes, such as:

- adjustments to depreciation expenses that reflected the higher carrying values of non-current assets;

- an allowance for the additional funds required to finance increases in trade receivables — the “working capital adjustment”;

- a gearing adjustment to measure gains made by equity investors at the expense of lenders; and

- the effect of all and any of these adjustments on taxable and distributable profits.

Separate sets of financial statements are confusing and additional disclosures are bothersome. Perhaps we should simply require a capital maintenance adjustment in the determination of distributable profits.

This is part of the Concepts series of articles.

© AccountingCafe.org

Notes, references and further reading

[Note 1] Plimmer, G. and Pickard J. (2022) ‘First phase of HS2 set to bust budget by “many billions” of pounds’, 15 October. FT.com (online) Available at: https://www.ft.com/content/b804b37c-52c2-41b7-801a-eece63de2bb3 (Accessed 19 October 2022).

[Note 2] The Institute for Government (2020) High Speed 2 costs. Available at: https://www.instituteforgovernment.org.uk/explainers/high-speed-2-costs (Accessed 20 October 2022).

[Note 3] IFRS Foundation, IFRS Conceptual Framework (2018), Chapter 8: Concepts of Capital and Capital Maintenance. Available at: https://www.ifrs.org/projects/completed-projects/2018/conceptual-framework/#published-documents (Accessed 19 October 2022)

[Note 4] Whittington, G (2017), Value and profit: An introduction to measurement in financial reporting. Cambridge. Buy at: https://www.amazon.co.uk/Value-Profit-Introduction-Measurement-Financial/dp/0521190975 (Accessed 30 November 2022)

[Note 5] One of the reasons inflation accounting raises the hackles for some people is that this type of transaction offends the orthodox definition of expenses. Expenses are transactions that decrease assets or increases in liabilities. This transaction increases equity.