Supply chain finance

Posted by Toby York. Last updated: April 12, 2024

Supply chain finance is making the news for all the wrong reasons. Although it is a centuries old form of finance, it has played a part in the demise of Abengoa, NMC, Carillion and most recently, Greensill.

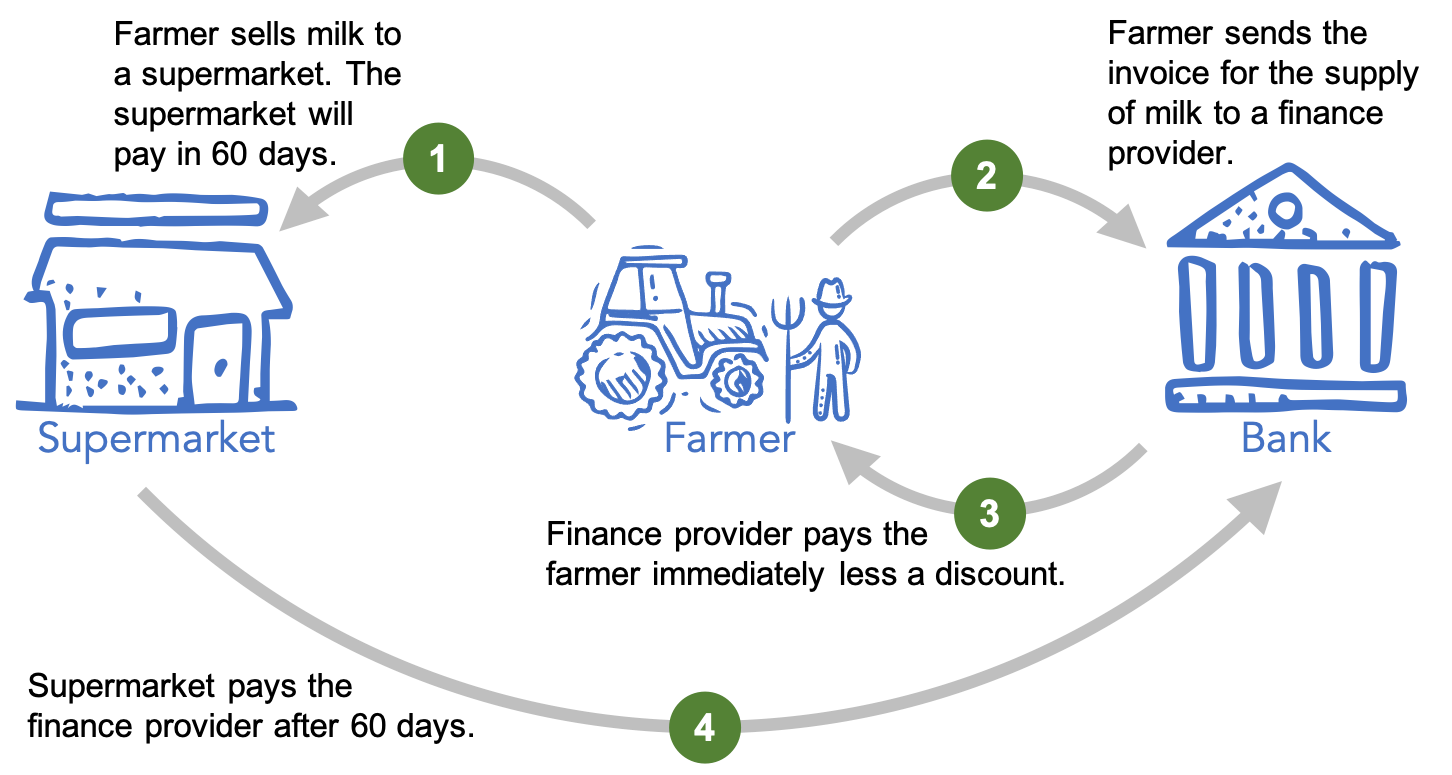

Here is a simple slide that explains the basic concepts behind factoring and supply chain finance. Download a version for PowerPoint below.

This raises some interesting questions for students (and regulators):

- Who has received financing from the bank: the supermarket or the farmer?

- How should the supermarket disclose the amount owed to the farmer in its financial statements?

In factoring, the finance provider extends credit to the farmer. In supply chain financing the finance provider extends credit to the supermarket. The supermarket will usually have a higher credit rating than the farmer, in which case supply chain financing will be cheaper than factoring.

Under current regulations, the supermarket discloses the amount owed to the farmer within accounts payable, even though this is more like a credit line provided by a bank. There is an argument that these amounts should be included as part of debt.

Whatever your view, there is a strong case for better disclosure within financial statements of this type of financing arrangement and better regulation of supply chain finance.

None of this is new. As far back as 2004, the Office of the Chief Accountant at the SEC objected to entitites classifying amounts due to financial institutions as accounts payable [note 1]. The editorial board of the Financial Times called for this on 4 March 2021 [note 2], and auditors have been seeking clarification from regulators for months.

In May 2023, International Accounting Standards Board (IASB) responded. From January 2024, it require entities to provide clearer information about supplier finance arrangements, through amendments to IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments.

© AccountingCafe.org

Download: Supply chain finance (PPTX)

References

- Comerford R. (2004) Speech by SEC Staff: Remarks before the 2004 AICPA National Conference on Current SEC and PCAOB Developments, U.S. Securities and Exchange Commission

Available at: https://www.sec.gov/news/speech/spch120604rjc.htm (Accessed 10 May 2021). - Financial Times (2021) Greensill case shows risks of supply chain finance. Available at: https://www.ft.com/content/706203ec-4786-48f1-b859-ffe4c9171eee (Accessed 7 April 2021).

This is by far the best explanation of supply chain finance that I have seen – well done Toby.