What’s going on?

Here you will find the most recent activities including articles, future events, recordings of past events, links to courses and other resources.

Sondos Bannouri explains how blending creativity with education has sparked a small revolution in teaching accounting concepts at Tunis Business School. Teaching innovations with creativity At Tunis Business School (TBS), I’ve implemented creative techniques to enhance student learning experiences and encourage active participation. Recognising the impact that visual aids have…Read more

The ICAEW Southern Intra University Competition, sponsored by Mazars in collaboration with ICAEW, offers students from the University of Southampton, University of Portsmouth, and Bournemouth University an opportunity to challenge their business acumen. Highlighting the path for future accountants, the ICAEW Southern Intra University Competition stands as a beacon of…Read more

Webinar: Tuesday 30 April, 2024 12 noon (London). Explore the importance of collaborations between education providers, students, and external organisations. Join ICAEW and Accounting Cafe to discuss the art of creating meaningful collaborations between education providers, students, and external organisations in a triple-win relationship. Discover innovative ways to bring real-life…Read more

Accounting Cafe needs help supporting its community. We seek an editor to oversee publishing articles, assist with event hosting, and help curate speaker programmes. Five good reasons to contribute to accounting education This is a voluntary position, but there are many non-financial benefits. What’s Accounting Cafe looking for? We are…Read more

Jerry Maginnis, CPA, former managing partner at KPMG’s Philadelphia office, explains the importance of developing “soft skills” among early career and student accountants. The “soft skills” gap Many accounting educators do an excellent job helping their students master the fundamentals of the profession. As a result, students who major in…Read more

Dr Neil Dunne shares five tips for prospective or new programme managers within academia. Every university differs, but Neil’s advice is transferrable across institutional and geographical boundaries. Introduction: a sudden jolt Picture the scene: you’ve just completed your first year of teaching at a great university. It was tough. But…Read more

Using research models and findings from Middlesex University GreenFin Research Cluster, Robyn Owen created a learning activity for postgraduate students studying entrepreneurial finance. This activity requires students to demonstrate their understanding of the challenges and opportunities of seeking sustainable investment funding. They do this by creating a pitch deck. Presenting…Read more

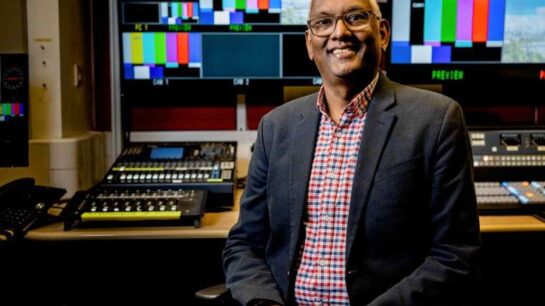

Driven by a passion for enhancing educational tools and fostering global collaboration among accounting instructors, Prof. Sherif Elbarrad is creating a teaching platform for accounting instructors to provide affordable, high-quality tools that enrich learning experiences. Microsoft Excel and its equivalents are vital components of many post-secondary programs. However, grading spreadsheets…Read more

On Tuesday, 16 April 2024, Professor Garry Carnegie presented “Redefining Accounting for Tomorrow”. In a thought-provoking webinar, he issued a wake-up call for accounting to re-examine its core purpose. He claims that accounting has become stuck in an outdated, narrow “technical mindset” that risks making it irrelevant, or even harmful,…Read more

Accounting Streams is a new project seeking help from a broad range of contributors to create a reimagined accounting curriculum. The Accounting Streams project seeks to reimagine accounting education for contemporary society by embracing the purpose of accounting and its economic, social, moral, and technical underpinnings. It embraces questions of…Read more

An Accounting Cafe live drop-in session on 7 February 2024 at 4.30pm. Come along for a chat. We’ll help you to teach accounting with confidence. An informal 45-minute session. This is an opportunity to pop in for a chat with course host, Toby York, during which he will answer questions…Read more

A webinar hosted by IFAAC and IAAER on 7 February 2024 launching a literature review, Educating Accountants for a Sustainable Future. It highlights key themes relevant to education, learning and development, and insights into how the profession can meet sustainability reporting demands. Educating accountants to advance sustainability With the increasing demand for…Read more

Hannah Macdonald, ACA, founder of Accountancy Hub. Hannah Macdonald is a chartered accountant. She created Accountancy Hub during lockdown in December 2020 to bring together in one place support for accountancy trainees. Accountancy Hub really puts the trainee first and is a community offering support focused on wellbeing, careers and…Read more

Joe Hoyle, Associate Professor and Accounting Teaching Fellow at the University of Richmond, shares wisdom, perspective and advice he’s acquired over half a century in accounting education. Joe Hoyle strongly believes colleges and universities should freely share as much educational material as possible. He says, “The world desperately needs substantially more…Read more

“Embedding Sustainability in Audit and Accounting Education – A forum for professional accountancy bodies, academics & training providers” was an event organised by the Financial Reporting Council (FRC) and the British Accounting and Finance Association (BAFA) at Alliance Manchester Business School on 1 November 2023. Toby York is a senior…Read more

Dr Anwar Halari, Senior Lecturer in Accounting and Dr Daniele Tori, Lecturer in Finance, at The Open University. We explain how we applied the “Black Mirror: Bandersnatch” concept to one of our online accounting modules. An interactive movie that allows you to shape the story with your choices and lets…Read more

Accounting Cafe members met in person at St Matthew’s Conference Centre in Westminster, London, on Friday, 26 January 2024, for “Pop-up Symposium 2024”. Attending Accounting Cafe’s Pop-up Symposium gave me lots of inspiration. First, because you realize there are many ‘like you’. Second, all the ideas fellow accounting educators are…Read more

Pam Dodd is a senior lecturer in accounting at Liverpool John Moores University (LJMU). Pam has a vision for an Accounting Clinic in every university in the country. She explains how they benefit the community while providing students with the opportunity to learn accounting by doing it. In 2007, while…Read more

Bruce Vivian, Head of Accountancy Education at IFAC, shares information on IFAC’s Sustainability Reporting Project and the perspectives of other accounting educators. IFAC is a global organisation seeking to enhance the relevance, reputation, and value of the global accountancy profession. It represents millions of professional accountants worldwide through its members…Read more

Samantha Bell is a senior lecturer in accounting at the University of Bristol. Sam Bell considers the impact of AI in accounting coursework assessments. She explores how questions and rubrics can be adapted to deter improper use of Large Language Models (LLMs) such as ChatGPT, Google Bard and BingChat. She…Read more

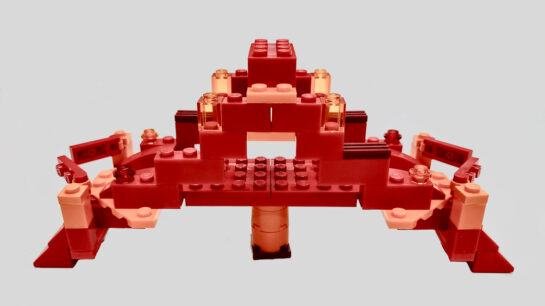

Helen Brain describes her experiences setting up a Lego challenge for students in her introductory management accounting class. Like you, I’ve pondered long and hard about the best way to teach basic accounting principles. I’ve often encountered final-year students who struggle to apply more complex techniques or tackle advanced problems.…Read more

This article is based on a presentation that Sara Saynor, Senior Teaching Fellow at Aston University. Sara presented this case study about using authentic assessment at the Accounting Cafe Pop-up Symposium in March 2023. Rationale and aims I often reflect (lose sleep!) on the challenge of developing a well-rounded graduate…Read more

This article is based on a presentation by Monina Hurl at the Accounting Cafe Pop-up Symposium in March 2023 in which she explored the merits of PowerPoint vs workbooks. The good old days I’ve been a lecturer for many, many years. I started my career at a college training students…Read more

I recently addressed accounting educators at a conference about using learning science in accounting education. My session was immediately after lunch. Anybody with teaching or training experience knows that these postprandial slots are challenging. You’re up against the biological processes of metabolism — your audience feels sleepy and has trouble…Read more

Who says accountants aren’t creative? We’ve got fascinating presentations lined up for the Accounting Cafe Pop-up Symposium. Our speakers come from Liverpool, Bristol, Birmingham, Winchester, Exeter and London with a wide variety of initiatives and innovations. We meet at Hawkwell House, just outside Oxford, this Friday, 21 April 2023. It…Read more

Summary: The origins of accounting are uncertain, various, and remain a mystery in parts of the world. However, one tantalising theory for its development in Western culture begins in Mesopotamia and is tied up with the invention of agriculture. The history of accounting is deeply entwined with the history of…Read more

Accounting Cafe members met in person near Oxford on Friday 21 April 2023, for its “Pop-up Symposium 2023” It was a delight to spend the day with enthusiastic, energetic, and creative accounting educators at Accounting Cafe’s Pop-up Symposium. Oxfordshire’s beautiful countryside helped, as did the inspiring and engaging content. Lightning…Read more

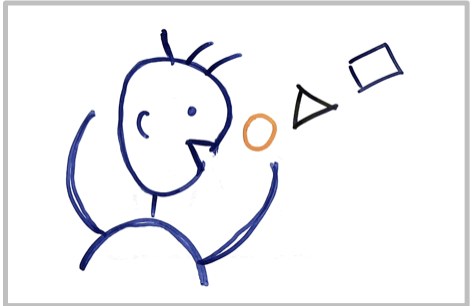

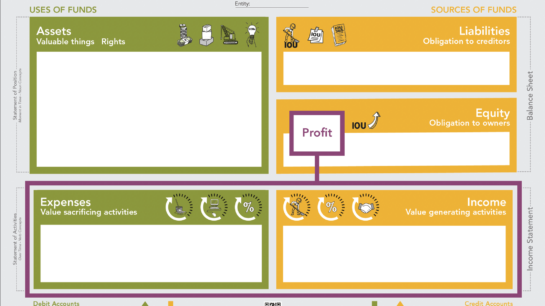

Summary: A simple way to embrace dual coding in accounting education is to use a concept map. This “almost certainly” improves learning. Don’t reinvent the wheel: there’s a free one that you can adapt, copy and distribute. Give credit to its creators. This is the BaSIS Board. It combines words…Read more

This event was organised by Rethinking Accountancy, part of the Rethinking Economics network. This was their first live seminar in February 2023. Professor Joan Ballantine, University of Ulster Joan Ballantine outlined a historical context of accounting degrees, explaining that as their number has expanded, they’ve been shaped by increased competition…Read more

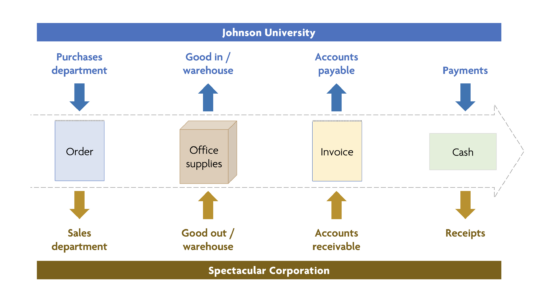

How role play in accounting education creates an effective and engaging lesson about a topic that can feel very dry. This example uses a case study to explore the processes involved in simple transaction cycles. I introduced this activity in an Accounting Information Systems (AIS) course for first-year undergraduates studying…Read more

Right after Christmas your body reminds you, uncomfortably, of all the extravagant dinners you’ve had. But have you thought about connecting the body with learning? Susan Hrach [pronounced ‘rock’] does so in her book ‘Minding Bodies’. [Ref. 1] She makes two claims. One, the body needs to be in a…Read more

Historical cost accounting has its advantages but presents serious problems in periods of inflation. In Autumn 2022, the board in charge of the £100bn project to build HS2, the UK’s high speed railway, was criticised for using 2019 prices to report its current spending. This had the effect of reducing…Read more

Last month saw the IgNobel awards for “achievements that first make people laugh, then make them think”. My personal recent favourite is the 2019 award to economics researchers who tested which country’s paper money is best at transmitting dangerous bacteria. It’s precisely this ‘silly but serious’ theme that struck me…Read more

This article explains what the Chart of Accounts is and how it can be used in teaching and assessments. It’s a topic that’s addressed in Accounting Information Systems courses, but has relevance to more general accounting education too. It’s an important part of the plumbing system that connects each piece…Read more

As the roles of wisdom, tradition, community and faith diminish, inequality and plutocracy rise. Professor Atul Shah presents a new theory of inclusive and sustainable finance to encourage students to embrace sustainability ideals. …Read more

An Accounting Cafe live online seminar for teachers was held on 28 September 2022 This 30 minute session outlined an innovative educational approach to teaching the accounting elements of BTEC Business. During the session there was an opportunity to speak with the course leaders, Colin Leith and Toby York, and…Read more

An Accounting Cafe online seminar at 3pm on 16 September 2022 with a call to action for institutions to collaborate in their provision of employability opportunities and skills for accounting and finance students. Mind the GAAP has been a collaboration between Accounting and Finance students and staff at the University…Read more

You may not think that accounting is political or that accountants should meddle in economics and politics. After all, their job is to report objectively on the performance and condition of corporations. Faithful representation, as we know, requires neutrality. Corporations, however, are social inventions and financial reports are never passive…Read more

This is a brief introduction to the nature of money and its relationship with accounting. It explains how accounting creates money. This is a fun way to introduce accounting, making learners think differently about accounting. Accounting isn’t just about counting beans — it makes them too. It may be hard…Read more

This course is for you if you’re new to teaching accounting in higher education, or are perhaps considering a career move to accounting education. It’s designed to provide friendly support and to help you take the next steps in building your career, improve your teaching and engage your students. The…Read more

Accounting students are understandably keen to put numbers next to everything. But often our students don’t understand why and how numbers are attached to words in financial statements. IFRS uses the term ‘measurement’ (rather than ‘valuation’) to describe the process of quantifying resources and obligations. Measurement allows us to describe…Read more

This Accounting Cafe online seminar on 25 March 2022 explored the future relationship between universities and the professional accounting bodies. Our guests argued that to protect the future of accounting education a new social partnership is necessary between universities and the professional accounting bodies. A significant problem is the current…Read more

Accounting students are understandably keen to put numbers next to everything. But often our students don’t understand why and how numbers are attached to words in financial statements. IFRS uses the term ‘measurement’ (rather than ‘valuation’) to describe the process of quantifying resources and obligations. Measurement allows us to describe…Read more

Here are fifty minutes of ideas and practical suggestions to help you to deliver innovative accounting teaching, learning and assessment. We follow this with a discussion and experiences from other enthusiastic accounting educators from across the world. On 17 February 2022, Accounting Cafe hosted Susan Smith, an innovative and prize-winning…Read more

When accounting students understand that classification of assets and liabilities is an important step towards deciding how to report events, then they appreciate the importance of professional judgement in accounting. Here are some tips for teaching classification. …Read more

Alice Shepherd is an Associate Professor of Accounting and Finance at Leeds University Business School, Senior Fellow of the Higher Education Academy, and an award winning teacher with specialised knowledge of online and distance learning. Embedded case study A single company case study is embedded into the course, so that…Read more

On 7 December 2021, Colin Leith and Toby York hosted an introductory seminar to a free online course for Level 3 teachers called “Teach accounting with confidence”. Colin Leith is Economics, Business and Esports Subject Advisor at Pearson Education and Toby York is a chartered accountant, Senior Lecturer at Middlesex…Read more

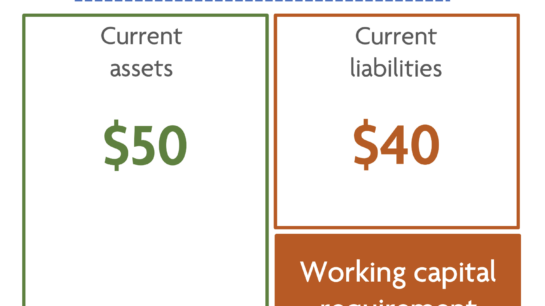

Working capital is a widely used but often misunderstood term. To teach it well, the term needs careful scrutiny. The problem starts, as it usually does, with language. ‘Working’ isn’t a helpful term. Working capital suggests that this capital works, and the rest of it doesn’t. ‘Capital’ is ambiguous and…Read more

Accounting Cafe online seminar on 19 November 2021 Liz Marsland is a trailblazer in phenomenon-based learning. She unpacks the methods, the challenges and the benefits to students and teachers in using this multi-disciplinary approach that has wide application across subject areas and throughout educational levels. Elizabeth Marsland CPA SHEA, from…Read more

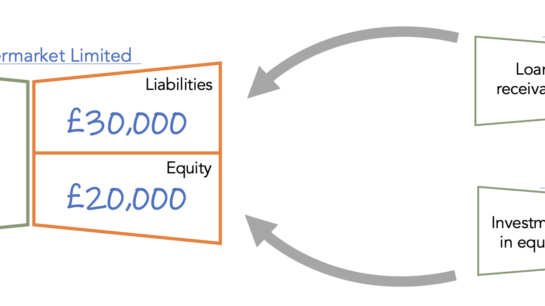

Of the five financial statement elements, equity is the most mercurial. In part, because it’s total amount is measured as the total of recognised assets less the total of recognised liabilities, expressed in this form of the accounting equation. Assets – Liabilities = Equity (net assets) Measuring total equity as…Read more

Accounting Cafe online seminar on 28 October 2021 The most generous estimates reckon 2/3 of the planet can’t answer some basic questions on finance, but plenty of that 1/3 have guessed their way to those answers with a bit of basic numeracy—the survey is multiple choice, so the planet is…Read more

Accounting Cafe online seminar on 23 September 2021 Hilary Lindsay contends that complete professionals are those who continue to learn in response to their environments. This requires more than professional knowledge and skills. It requires career adaptability. Whether you are at the beginning, middle, or coming to the end of…Read more

At Accounting Cafe we’re discussing how we can clear up the confusing things about accounting. Terms that we take for granted are confusing for students. Make their learning journey faster and easier using these simple tips. Here are our top 5 most confusing things about accounting: 1. The most valuable…Read more

Paul Jennings gives some useful tips and sequences for teaching liabilities. The elements of financial statements are the building blocks of financial statements. If your students understand what the elements are then they will understand the basis for reporting events in financial statements. Those elements – assets, liabilities, equity, income…Read more

Dictionaries, from an accounting perspective, invariably provide an incorrect and conflated definition of income. …Read more

The elements of financial statements are the building blocks of financial statements. If your students understand what the elements are then they have a good basis for understanding how events are reported in financial statements. Those elements – assets, liabilities, equity, income and expenses – are key to understanding financial…Read more

Do you think accounting can be fun? Is there a way to make it less boring and more engaging? Do you believe that learning accounting is easy and something everyone can do? …Read more

Expenses are a perfect illustration of how accounting uses common language in specific and uncommon ways. …Read more

Todd believes that accounting is not only broken but is contributing to the destruction of the planet. He is calling on accounting academics to help fix this. …Read more

Paul Jennings gives some tips on how to explain the nature of depreciation. …Read more

Set up an Accounting Club in your local school. It is such a hugely rewarding activity that positively impacts students. If you’re ready to introduce Accounting Club into your school and want to be an accredited Accounting Club Educator — an ACE — the information you need is in Accounting Clubs in Schools …Read more

Presentation by Toby York TACTYC Virtual Annual Conference on 15 May 2021 1. Background paper My presentation, in three parts, is based on a draft paper, The benefits of concept mapping in accounting education [PDF]. Part one: identifies some common problems with current accounting education practices, drawn chiefly from personal…Read more

Toby York and Paul Jennings hosted a Zoom seminar on 20 May 2021 This was the third seminar in a series about using concept maps in accounting education. Session 1: Concept mapping in accounting education Session 2: The funding butterfly This approach emphasises the organisational structure of accounting knowledge, which…Read more

Presentation by Toby York at the Games and Simulations in Accounting and Finance Education (‘GSAFE’) conference hosted by Aston University on 20 April 2021 The benefits of concept mapping in accounting education My presentation is based on a draft paper The benefits of concept mapping in accounting education, which is…Read more

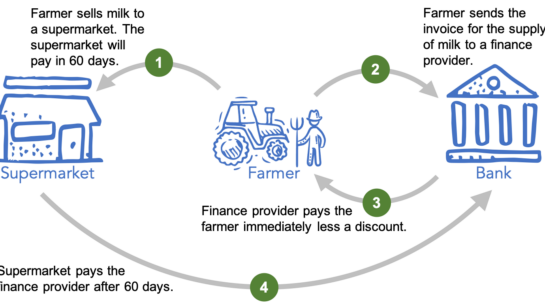

Supply chain finance is making the news for all the wrong reasons. Although it is a centuries old form of finance, it has played a part in the demise of Abengoa, NMC, Carillion and most recently, Greensill. Here is a simple slide that explains the basic concepts behind factoring and…Read more

Helping students to understand, rather than just memorise, IFRS principles. This article is also relevant to FASB’s Statement of Financial Accounting Concepts No. 8: Conceptual Framework for Financial Reporting. The IFRS Conceptual Framework underpins what international financial reporting standards say and why they identify a particular accounting treatment. Students must…Read more

Toby York and Paul Jennings hosted a Zoom seminar on 18 March 2021 Zoom cloud recording (34 minutes): Toby York demonstrates the “funding butterfly”, part of the Colour Accounting method, which he uses to introduce students to the accounting equation. Starts Content 00:00 Introduction 02:04 The BaSIS FrameworkTM 04:35 Where…Read more

Using H5P to create Colour Accounting interactive content …Read more

The battle to remove “prepayments” from accounting vocabulary is probably not winnable, but we can help our students by being clear about how we describe them. …Read more

Goodwill represents those ‘unidentified flying assets’ that can’t be individually identified. Goodwill is one of those slippery concepts that accounting students can find confusing. Accounting for it brings the student in front of a number of difficult questions and misconceptions in accounting, such as the nature of an asset and the…Read more

With the risk of sounding like the gun lobby, there’s nothing wrong with PowerPoint, only PowerPoint users. Like it or not, we’re in the communications business and our audiences know what good comunication looks and sounds like. Here are my rules for slide design. It is not lesson planning software…Read more

Aston Business School’s virtual conference takes place on 20 April 2021 The GSAFE virtual conference explores games, simulations and playful learning in accounting and finance education. The themes cover pedagogical techniques in learning, teaching practice and research. Plenary presentations: Professor Jordi Carenys (EADA Business School) Matt Davies (Aston University) Susan…Read more

Toby York hosted a Zoom seminar on on 18 February 2021 Starts Content 00:00 Introduction 05:19 Module learning outcomes 06:60 The BaSIS Framework 10:45 Introducing accounting to students 14:27 Conversation 1: point of view 16:25 Conversation 2: the funding butterfly 27:32 Conversation 3: deriving profit 30:00 Materials and implementation 31:45…Read more

With gratitude to Paul Jennings for this clever idea. Some students find it difficult to appreciate that assets are rights, not things in and of themselves. I used to tell students that in the old days we put motor vehicles on balance sheets but they kept falling off. It didn’t…Read more

Let’s be clear. Nobody learns the fundamentals of accounting by using DEAD CLIC. Mnemonics may have their place, but this isn’t one to keep. Let’s kill it off. A friend told me that when she was learning accounting, she dared to ask, “Why do debits increase both expenses and assets?”…Read more

A version of this article was first published on LinkedIn on 30 July 2020. Concept maps are visual representations of information that show everything in a single view. They help students to create a clear mental model, which clarifies their thoughts and provides a shared language of understanding in a…Read more

This article was first published on Linkedin on 4 July 2018. Last week I was in a meeting to plan a Jazz Mass at St Matthew’s Westminster next Autumn. During the conversation Ewan, the lead musician, assured us that the congregation would be able to sing along with the hymns…Read more